Click Check my Orders under Place an Order or My Portfolio to monitor your trade status (Note: Because you placed a limit order it could take some time for your order to be filled, if it is filled at all).Click Confirm on the Confirm Transaction page.Enter a Limit Price and a Stop Price (Note: Investors generally choose a Stop Price that is below the last Bid Price, and the Limit Price must be equal to or less than the Stop Price).

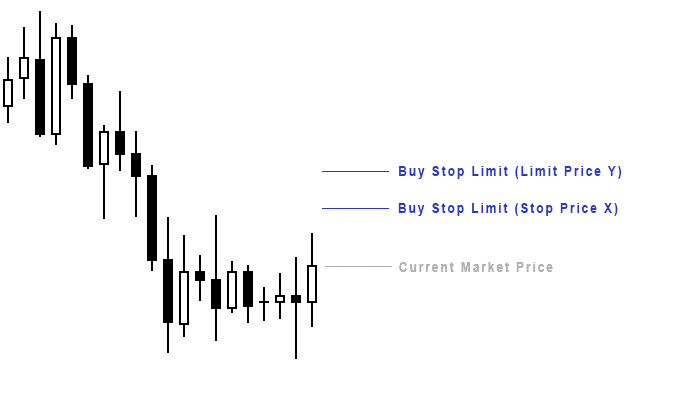

Symbol and Market data will be pre-populated.In this scenario, the stop-limit sell order would automatically become a limit order once the stock dropped to 50, but the traders shares wouldnt be sold unless they could secure a price of 49.50 or better. A stop limit order is an order to buy or sell a specified quantity of an asset only if and when the stop price is reached and then only at or better than a. For Account #, confirm that you have selected the correct Practice Account from the drop-down menu For example, a trader placing a stop-limit sell order can set the stop price at 50 and the limit price at 49.50.In the holdings table, locate your RBC shares and then click the Sell link (in the Actions column).Using the My Accounts drop-down menu, select the appropriate Practice Account and click Go.Click My Portfolio Holdings under My Portfolio.In order to practice this transaction, your Practice Account must already hold 100 shares of "RY". In this example, you will place a stop limit order to sell 100 common shares of RBC (ticker RY). The following instructions lead you through the steps to perform in the main browser window. From the ‘symbol’ drop-down list, choose the currency pair you want to trade. Let’s say you’ve successfully bought your 0.1 BTC at the 29,000 price. Here are the steps to place pending sell limit and sell stop orders Click tools > New Order button. With a stop-limit order, your trade will only go through at your desired price or better. For example, if youre planning to sell 300 shares, and the price falls below the limit price when only 200 shares are sold, 100 are not executed. You will want to refer back to it as you perform this transaction. The limit price adds an extra control by setting a more precise price constraint on your trade.

0 kommentar(er)

0 kommentar(er)