In the context of the trader’s account, the drawdown is calculated as a temporary drop in the value of the account that is regained afterward. It drops $15 to $285 and then gets back to $300.01. In this context, the drawdown is basically the negative half of the standard deviation in relation to a particular instrument’s price. Let’s start with drawdown as a measure of an asset’s financial risk. To understand how it works, we will analyze both contexts it is applied in.

#Stock drawdown chart professional

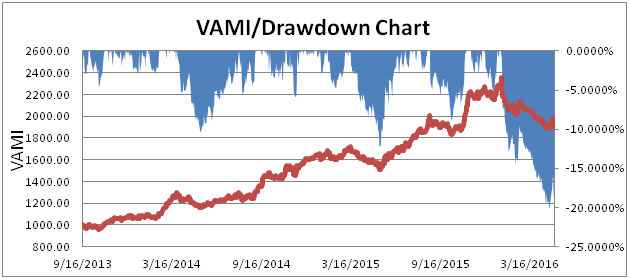

When reading professional trading guides or threads on trading forums, you may see others using the term “performance drawdown.” However, it is just another way to refer to a particular trader’s drawdown strategy over a certain period of time. It is registered once the price hits its second peak and closes the drawdown. However, we often also refer to drawdown as “unrealized loss.” As you can see from the chart above, the drop is temporary. A drawdown is a temporary peak-to-trough metric, while the loss is calculated based on the purchase price relative to the instrument’s current or exit price. It’s not the same as a lossĭon’t confuse a drawdown with a loss. In general, however, a drawdown can take anywhere from a few trading hours to several months when it comes to the market. Understandably, that is also the case with trading accounts.įor example, if a particular instrument experiences a notable 10% drawdown and gets back to its peak in just a few seconds or minutes, then the most likely reason is a flash crash, which shouldn’t concern investors too much. The quicker the instrument regains its price, the better it is for the trader. When analyzing drawdown from the perspective of an instrument’s price or an account’s value, it is essential to note that the time it takes to recover from the drop is another key characteristic. The bigger it is, the more volatile the particular instrument had been (and will likely continue to be). In the context of trading, we can also describe drawdowns as downside volatility. That way, traders can better identify whether the particular instrument fits their risk tolerance and investment goals. – Warren Buffet What is a Drawdown in Trading?ĭrawdowns in trading are important because they help traders measure the historical risk of instruments or evaluate their performance.įor example, the drawdown of an ETF, futures contract, or a stock can indicate how risky and volatile the instrument had been in the past. “Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market.”

#Stock drawdown chart how to

If you learn how to manage them and adopt adequate risk management strategies, you can reduce the effect such situations have on your trading performance. If the market has so many drawdowns, then it is normal for your trading account and the assets in your portfolio to have them. More than 40% of these drawdowns exceeded 20%. In addition, over an almost 200-year period of market history, investors had been in a drawdown 74% of the time.

According to some estimates, the S&P 500 has a 5% to 10% drawdown approximately 12.8% of the time.

0 kommentar(er)

0 kommentar(er)